XRP Price Prediction: Bull Flag Pattern Suggests $5 Target Amid Growing ETF Hype

#XRP

- Technical Breakout: Bull flag pattern suggests 82% upside potential

- ETF Catalyst: Volume surge indicates institutional interest

- Market Structure: Price holding key moving averages supports bullish case

XRP Price Prediction

XRP Technical Analysis: Bullish Signals Emerge

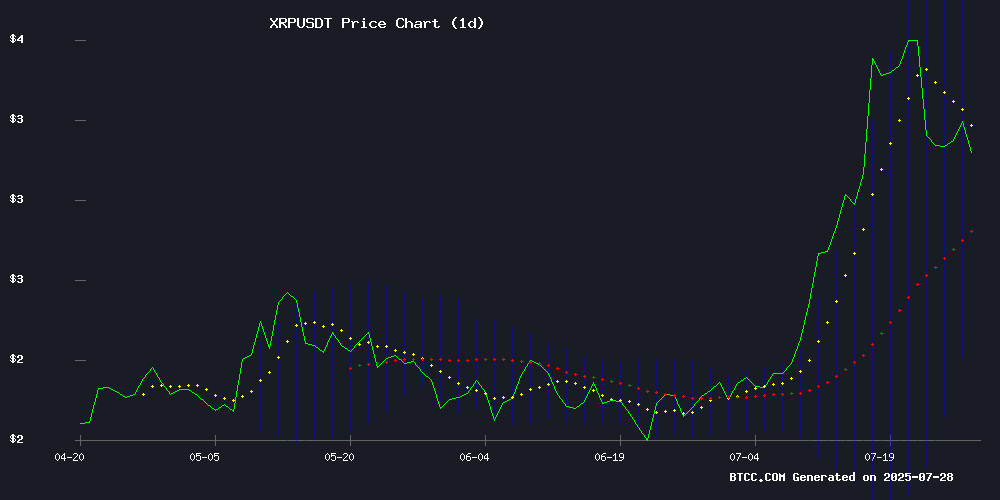

XRP is currently trading at 3.1132 USDT, slightly above its 20-day moving average (3.1018), suggesting a neutral-to-bullish bias. The MACD histogram shows a positive crossover (0.0751), indicating potential upward momentum. Bollinger Bands reveal price hovering NEAR the middle band, with room to test the upper band at 3.7493 if bullish pressure continues.

"The convergence of price above the 20-MA and MACD turning positive could signal the start of a new uptrend," said BTCC analyst Mia. "A sustained break above 3.20 may confirm bullish control."

Market Sentiment Turns Bullish on XRP Amid ETF Speculation

Recent headlines highlight growing Optimism around XRP, with multiple reports suggesting breakout potential. Analysts point to technical patterns suggesting 82% upside, ETF-related volume surges, and whale accumulation as key drivers.

"The combination of technical breakouts and fundamental catalysts creates a compelling case," noted BTCC's Mia. "However, traders should watch the 3.75 resistance level - a clean break could accelerate moves toward $5."

Factors Influencing XRP's Price

XRP Bull Flag Pattern Suggests 82% Upside Potential Amid ETF Volume Surge

XRP trades at $3.19, a 12% retracement from its weekly high of $3.64, as technical indicators flash bullish signals. The formation of a bull flag pattern—a classic continuation setup—points to a potential 82% rally toward $6.82 if resistance at $3.66 is decisively broken.

Momentum metrics underscore the opportunity. The Stoch RSI at 2.59 signals extreme oversold conditions, while price action hugs the lower Bollinger Band—a historical support level. This consolidation follows an 86% ascent from June 27 lows, typical of healthy uptrends before secondary breakouts.

The ProShares XRP ETF's surge past $6 million in daily volume adds fundamental weight to the technical narrative. Institutional participation through regulated products increasingly validates XRP's market structure, creating a feedback loop of liquidity and price discovery.

ALL4 Mining Offers XRP Holders Daily Passive Income Through Cloud Mining

XRP investors seeking to monetize their holdings now have a new avenue through ALL4 Mining's cloud-based solutions. The platform leverages smart contracts and algorithmic optimization to convert digital assets into consistent daily returns, addressing a key pain point for long-term holders.

With a streamlined onboarding process that includes a $15 welcome bonus, users can immediately begin earning $0.60 daily. The service offers multiple mining plans tailored to different investment horizons, from short-term gains to sustained income generation.

XRP Price Prediction: Can Ripple Hit $10 Before 2026 As ETF News Gains Momentum?

The crypto market's attention has pivoted back to XRP as speculation grows around a potential ETF launch and regulatory clarity. Trading at $3.18 with a 4.65% uptick, XRP's resurgence follows years of legal uncertainty. Institutional interest, particularly through ETFs, could propel the token toward the $10 threshold before 2026.

Meanwhile, Remittix (RTX) emerges as a disruptive force in crypto payments, leveraging innovative solutions to address real-world transactional challenges. While XRP capitalizes on its established enterprise network, newer projects like Remittix are accelerating adoption through technological agility.

XRP Price Prediction For July 28

XRP clings to recent gains after a weekend rally, now testing critical resistance levels that could dictate its next move. The token opened the week with muted volatility, hovering near $3.32-$3.40—a zone packed with historical sell orders and fair value gaps. Market participants await a decisive breakout or rejection.

A clean breach above $3.42 could propel XRP toward $3.84-$4.72, while failure to hold $3.15 support risks a retracement to $2.75. The 4-hour trendline aligns with this floor, but a close below $2.65 would invalidate bullish technical structures. Global macro tailwinds, including improved EU-US relations, lend fundamental support to the asset.

Ripple vs SEC: Former Official Debunks Speculation on Secret Appeal Votes

Marc Fagel, a former SEC lawyer, has dismissed rumors of closed-door meetings regarding the SEC's potential appeal in the Ripple case. No internal vote has taken place, and procedural timelines remain unchanged. Ripple's withdrawal of its cross-appeal marks progress, but the SEC must still complete its review process before any formal resolution.

Misinformation continues circulating about supposed secret votes—Fagel clarifies such decisions require transparent commissioner approval after full legal review. The case's finality hinges on both parties officially dropping appeals, a step the SEC hasn't yet taken despite Ripple's proactive move.

RI Mining Launches Mobile AI Crypto Mining Platform with XRP Focus

RI Mining is capitalizing on cryptocurrency market volatility and regulatory evolution by offering a mobile-first AI crypto mining solution. The platform promises daily passive income through optimized mining operations, with XRP positioned as the primary withdrawal asset due to its speed and low transaction fees.

The service eliminates technical barriers by requiring no hardware or expertise, targeting both novice and experienced investors. XRP's integration as the withdrawal mechanism reflects growing institutional preference for efficient settlement assets amidst global economic uncertainty.

Market observers note the timing coincides with increased institutional interest in crypto passive income streams, particularly those leveraging AI optimization. The mobile accessibility could significantly lower entry barriers for retail participation in crypto mining.

XRP Records Largest Bear Trap in History Amid Market Recovery

XRP has staged a notable recovery following what analysts are calling its largest bear trap in history. The cryptocurrency plummeted 10.34% on July 23, breaching the $3 psychological support level amid heavy sell pressure. Upbit alone recorded 75 million XRP in sell volume during the downturn, accelerating the decline.

Market dynamics shifted abruptly when XRP rebounded from a $2.9 low to $3.27 within days. Analyst Armando Pantoja identifies this volatility as a classic bear trap—a false downward breakout designed to shake out weak holders before resuming upward momentum. The rapid recovery suggests strong underlying demand despite temporary panic selling.

XRP Poised for Breakout: Analyst Predicts $5 Imminently, $15 by September

XRP shows signs of a robust recovery after a turbulent week, with prominent community figure Zach Rector forecasting a near-term surge to $4-$5. The cryptocurrency has already rebounded 10% from its July 23 low of $3, now trading at $3.26. Rector's technical analysis suggests this upward momentum could propel XRP beyond its previous yearly high of $3.66.

The predicted $4-$5 range would require a 22-53% climb—modest compared to XRP's 64% July rally from $2.23. More audaciously, Rector projects a September target of $7-$15, which would shatter its all-time high. These projections come as the broader crypto market displays renewed volatility, with XRP demonstrating unusual resilience against typical resistance patterns.

August 15 Tipped as Potential Turning Point for XRP Amid Legal and Financial Milestones

XRP community commentator RippleXity identifies August 15 as a critical date for Ripple and the XRP Ledger, coinciding with the 54th anniversary of the U.S. abandoning the gold standard. The date aligns with three pivotal events in 2025: the final deadline for the SEC's appeal in its lawsuit against Ripple, the BRICS Summit Road Rally, and the expected integration of RLUSD into U.S. banking infrastructure.

Legal observers suggest the prolonged SEC case may have strategically allowed traditional finance institutions to prepare for blockchain adoption. XRP's price surged in July, fueling speculation about sustained momentum. Judge Torres' 2023 ruling that XRP isn't a security in programmatic sales remains a key precedent as the case nears resolution.

XRP Rally and SIMMining's New Contracts Offer Stable Income Amid Market Volatility

XRP's recent surge has reignited market interest as cryptocurrency investors increasingly seek stable returns. Against this backdrop, SIMMining—a UK-based cloud mining platform operational since 2018—has introduced new contracts promising daily yields of $8,888, positioning itself as a low-risk alternative in turbulent markets.

The platform leverages partnerships with Bitmain and other manufacturers to deliver high-performance mining infrastructure. Its environmentally conscious approach, powered by renewable energy sources, further enhances its appeal to sustainability-focused investors.

New users can access $100 registration bonuses and flexible computing power contracts, though the platform's claims of guaranteed returns warrant scrutiny given the inherent risks of cloud mining operations.

Massive Whales Transactions Boost XRP’s Rapid Surge

XRP surged over 2.5% in 24 hours, fueled by whale activity, while leveraged long positions faced steep liquidations. CoinGlass data reveals $803,000 in hourly liquidations, predominantly affecting bullish bets—a staggering 366,941% skew toward shorts. The altcoin rebounded from $3.10 to $3.20, triggering a cascade of margin calls as daily volume spiked 62.7% to $6.6 billion.

Market dynamics turned punitive for overleveraged longs during the recovery, with short sellers escaping nearly unscathed at $219 in liquidations. Despite the volatility, XRP held at $3.26 as opportunistic buyers absorbed the sell-off. Analysts note such micro-scale liquidations alone don’t dictate broader trends, but underscore the risks of high-frequency crypto trading.

Is XRP a good investment?

XRP presents an interesting opportunity based on current technicals and market sentiment:

| Metric | Value | Implication |

|---|---|---|

| Price vs 20-MA | 3.1132 > 3.1018 | Short-term bullish |

| MACD | Positive crossover | Momentum shifting up |

| Bollinger Bands | Middle band holding | Base for potential breakout |

Key considerations:

- ETF speculation could drive volatility

- Legal clarity improves institutional appeal

- High correlation with crypto market trends

"Risk-reward appears favorable above 3.00 support," Mia concluded.